When talking about personal finance we don’t really talk about banking methods. I’ve noticed that only 2-3 financial principles are in the center of the conversation. We constantly hear about budgeting, Dave Ramsey’s baby steps, and the Rich Dad Poor Dad’s philosophy. Even with all of this information, our fundamental knowledge of personal finances is still falling short. I constantly get frustrated with this issue, wondering why do we quit budgeting after a few months in? I’ve realized that no one has fully discussed how to properly set up our bank accounts so it could flow with your budget. So, I decided to talk about it and created the High 5 Banking Method to do so.

We’re offered to manage all of your finances through that one checking account and that one saving account that we are given when we first open our accounts. When running all of your expenses through one account and all of your saving goals through another account; things can get out of order quickly. This setup has only primed us to overspend on our lifestyle, which cuts into our bills and financial goals. Leaving us with an unfunctional budget, new debt, and financial stress every month. My goal was to create a simple banking strategy to fix this problem with the minimum amount of effort.

What’s the High-5 Banking Method?

The High-5 banking method is a simple way to remember the minimum amount of bank accounts that you need to keep your finances organized and straightforward. When we teach kids how to count we start with the basics of 1-5 and then move on to 6-10. I want to keep personal finance that simple and explain how to set up your bank accounts for success.

So, If you ever need a quick reminder of how many bank accounts you need just take a look at your hand. Each finger of your hand represents either a checking account or a savings account and here they follow:

1. Bills – Checking Account

Your bills are the mandatory expenses you have to pay or they will quickly affect your life and credit. These bills take up a large percentage of our income and staying ahead of these bills will help you from getting into debt or living paycheck to paycheck. Here is a small list of Bills that are considered fixed expenses.

Bills: Housing, Utilities, Debt, Car Note, Cell Phone, Internet, Insurance, etc.

The best way to make sure you keep your bills organized is to have a separate checking account to save for all of your upcoming bills. This way when you get paid you know exactly where to move your money. This will also tell you how much money you have to set aside for your upcoming bills. Now, this creates a simple routine after payday that allows you to always have enough money for your bills no matter what life throws at you.

2. Lifestyle – Checking Account

Your lifestyle expenses are going to be all of your non-bills expenses. These expenses are personal grooming, home essentials like toothpaste, and entertainment like Netflix and the infamous date nights. When we do our budget it might seem a bit difficult to foresee a birthday party or a quick happy hour, but being honest with your past expenses will make it easier. This category usually gets us into debt when we don’t have anything budgeted for fun or small expenses. The best thing to do is to have a separate checking account that holds all of your extra lifestyle expenses. This will help you to not overspend in this budgeted category or get you into debt. I would also recommend to take a good look at your budget and to give yourself a $50 or so buffer, just in case your still practicing financial discipline.

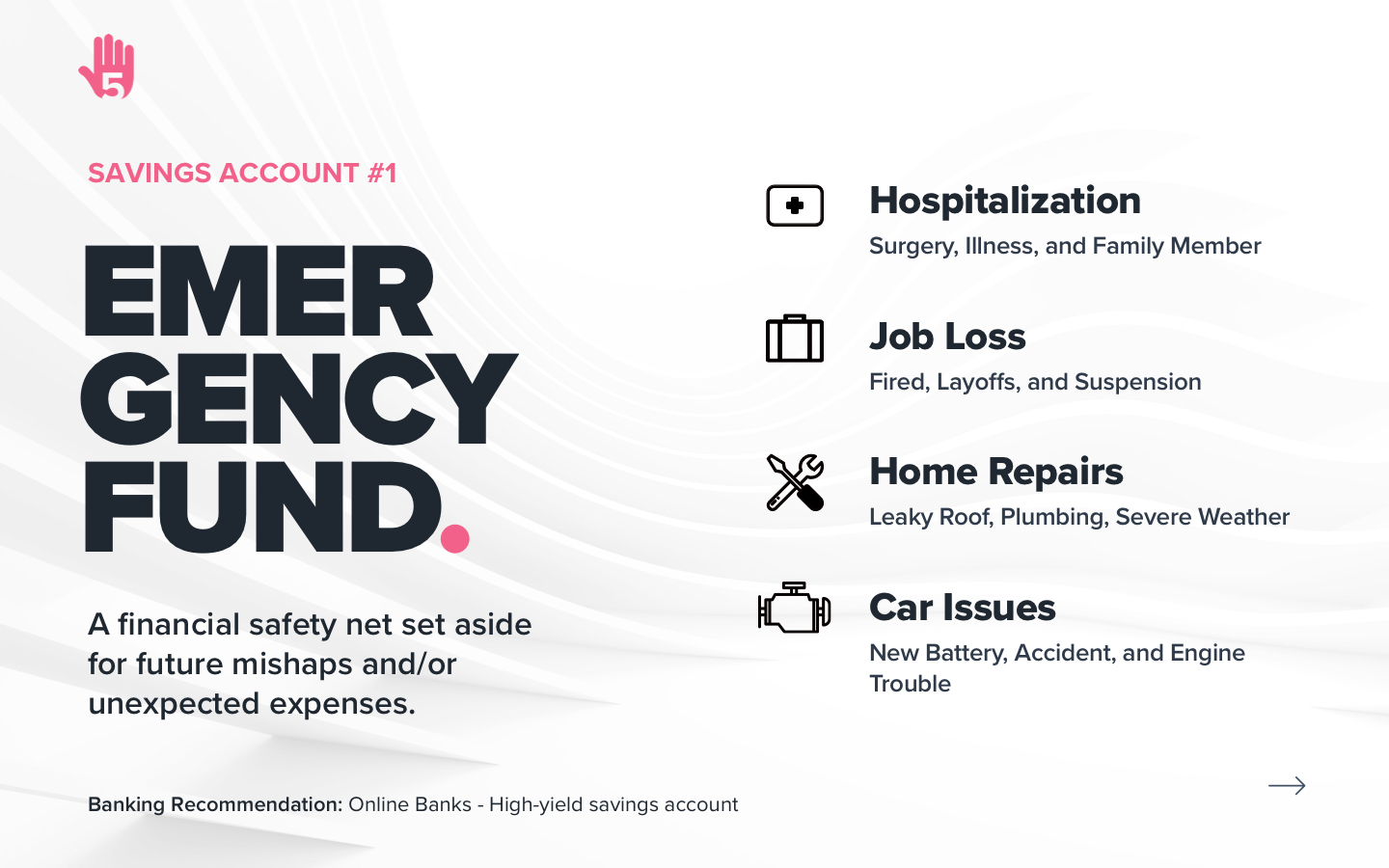

3. Emergency Fund – Savings Account

In my house, we call our emergency fund our F.U. money. This account gives us the confidence to say F.U. to any unexpected situation that tries to steer us off track financially. This is one of the most important saving accounts you need if you want any type of financial security. This type of account needs to be in its own separate savings account and should equal to 3-6 months of your bills depending on your current financial situation. Your emergency fund will be your personal financial safety net for any unexpected loss of income related to job loss, hospitalization, unexpected home repairs or car issues. We all know life isn’t perfect and pretending that it is will cripple your finances in the long run.

4. Short Term Goals – Savings Account

Saving the best for last, our semi-immediate goals that they call “short-term goals”. These are kind of immediate as you will be saving for these wants within the next 12 months. Short-term goals can be a summer vacation, upgrading your tech or even something you consider a luxurious expense. This can even be like a sinking fund, where you save for any upcoming expenses you need like car maintenance or a birthday party. Instead of flopping these expenses on your credit card and paying for it once we’ve enjoyed the experience. Let’s work on saving for our wants in its own savings account.

Once you see how much you have saved you will have tricked yourself out of getting into debt and are able to save for your experiences. This is very empowering when you’re on your financial journey. We want to see progress in our finances and have some fun in the sun without getting into debt.

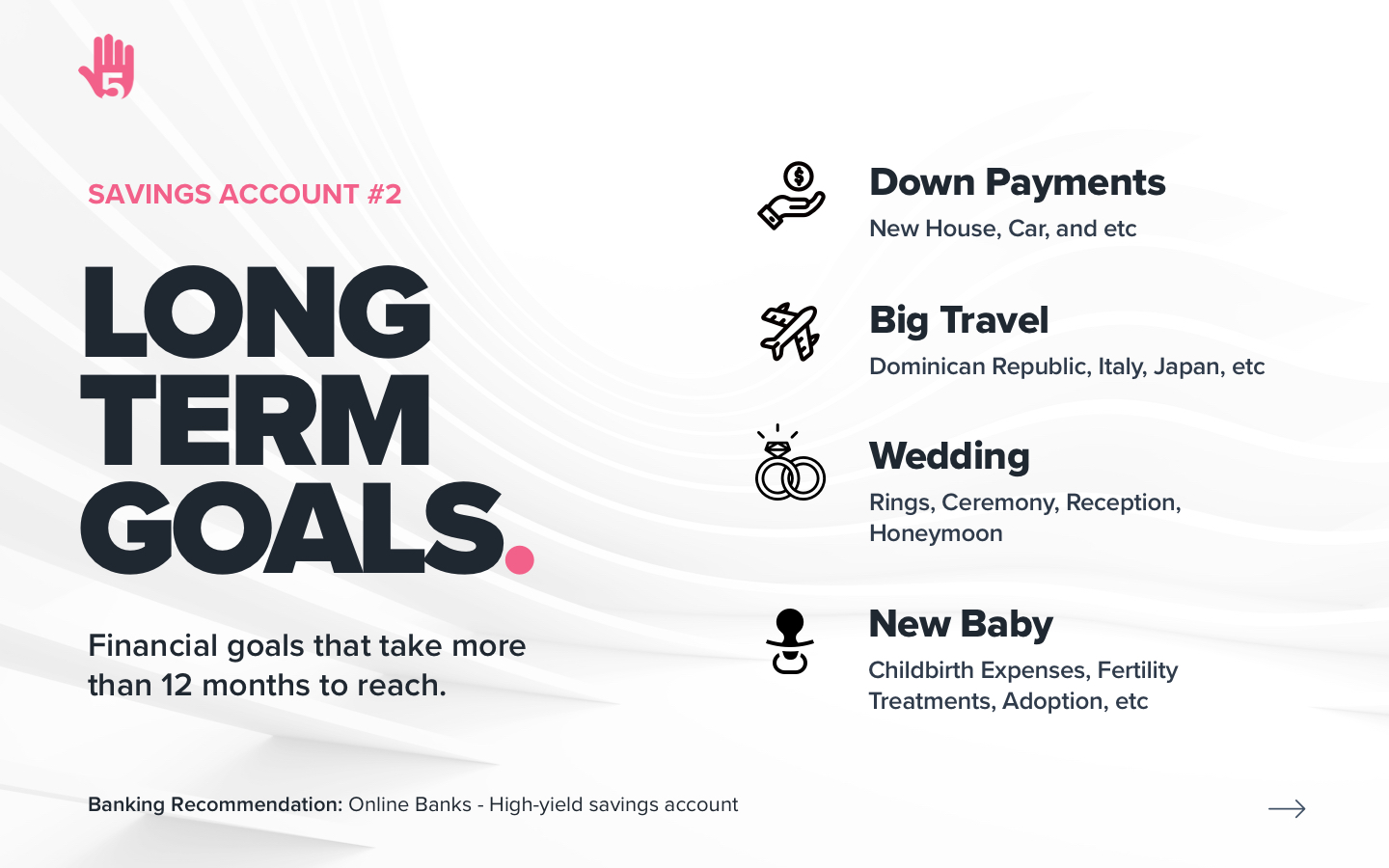

5. Long Term Goals – Savings Account

Like staying married is a long-term commitment and we all want to accomplish a few goals that we want to last the test of time. Most of these long-term goals have pretty pricey tags on them, as they are goals that will take you longer than 12 months to achieve. No matter the time frame these goals should be saved in a separate savings account where you can see your progress crystal clear. This will motivate you to continue saving for your long-term goals and not accidentally dip into your savings for any spontaneous wants. Keep in mind that it’s very important to give yourself a decent time frame to achieve your goals without adding unrealistic financial stress to your situation.

In Conclusion

At the end of the day, the purpose of the High 5 Banking Method is to help you better manage your money. We don’t want to solve a mathematical equation every time we want or need to spend money. Checking your budget and spending purposefully will help you on your financial journey, but making sure you have a system in place to protect your money from you is also an important financial step.

The High 5 Banking Method is just the minimum amount of accounts that I believe everyone should have to keep their finances in order. One thing that I’ve learned is that you don’t have to force your relationship with money within one checking and one savings account. You have access to online banks, college savings account, credit unions, and many other banking services to get your banking in order. This will make it easy to keep track of your money and financial goals without stress or fees.

#Shorts

2 Minute Q&A Tuesday Video

Related Content You May Like

-

Learn how to choose the best online bank for your personal financial situation. Plus get some bonus information on non-traditional banking options for your money.

-

Learn how to save money and avoid bank fees with my 4 banking tips.

-

Here are 4 money strategies to get better with your finances. From banking to even paying small bills off I share the tips that helped me get better with money.

-

They always say “don’t wait until hard times to save for hard times” with an emergency fund. Having savings specifically for emergencies has been such a game-changer for my family …