Do you guys ever get hit with those expenses that are so unexpected they just make you laugh? I’m talking about those unexpected doctor’s visits, or even when gas prices just jump up out of nowhere. These unexpected expenses were killing my budget month after month, and to be honest I was sick of it. I thought that getting on top of my budget would help me better prepare for these unexpected expenses. But it didn’t! That’s when I decided to create a First Aid Kit for my family’s budget and you should too.

What are Unexpected Expenses?

Unexpected expenses can be anything really, but for this blog, I want to focus on the unexpected expenses that are needed. They’re not as extreme that you need to visit the Emergency Room, but not predictable enough to budget for them. Some of the most common unexpected expenses that I’ve faced and that you can probably relate to are some of the following.

- Medical expenses: labs, medicine, or seeing a specialist

- Family needs: helping grandparents or parents with a small need like medical need

- Price increases for services: gas, utilities, cell phone, or groceries

The Grey Area of Personal Finance

How to handle unexpected expenses is a grey area within personal finance that doesn’t have a clear solution. We always hear to “just find the money”, but this isn’t a solution that’s feasible or realistic for most of us. What do you do when you’re living paycheck to paycheck? Most people have to make some tough decisions of whether they just put it on their credit card, use money that was budgeted for something else, pull from their savings, or even worst pull from their investments. Unexpected expenses or bill increases can hurt the best of budgets, that’s why it’s important to have a flexible strategy on how to handle this.

The Miscellaneous Budget Hack

My first attempt to fixing this issue was to use a little budgeting hack that I learned in my accounting class. Which was simply adding a miscellaneous line item to your budget. This is like a “net” that’s supposed to help you catch all the little things you forgot to budget for. In theory, this sounds like a great option to solve bill increases and any unexpected expenses. But the problem is that I knew that this was just an excuse to increase my budget and add some more spending money to my lifestyle.

Since college, I consistently added more and more money to my miscellaneous budget to catch any spur-of-the-moment expenses that I wanted. This line item in my budget wasn’t actually helping me stay on budget or better prepare for these unexpected expenses and bill increases. On the contrary, this little hack was just promoting me to swipe my credit card more and it was jacking my budget up. I needed another solution for this issue because just adding a miscellaneous line item to my budget wasn’t it.

Go into Debt or Pull from Savings?

My second attempt was to either go into debt or pull from my savings for these unexpected moments. To be honest, I couldn’t predict, plan, or budget for these kinds of things. Even when I had a scheduled doctor’s appointment that I saved for months in advance. I still got hit with some unexpected labs after that visit, which ended up costing me an additional $60 outside of my healthcare budget. Now I got stuck with swiping my credit card since I didn’t have enough money. These are the kinds of unexpected experiences that start to stack up on the credit card bit by bit. We feel stuck because we need to purchase whether we like it or not. Then we try to clear the debt a few months later by draining our savings. These are the tough decisions you have to make, whether you like it or not.

Not Another Failed Budget

I remember telling myself, “Wow, not another failed budget”! This made me furious and unmotivated to even look at my finances. Instead of feeling confident about my finances, I knew that I wasn’t preparing myself to handle these moments if they came up again. Because life will show you that if you don’t face whatever is chasing you, it will keep repeating itself to you until you face it. I had to stand up and face my failed budget and saw that my budget isn’t concrete, my budget can get hurt just like me. All the cuts, bruises, and inflammation is part of life. So get ready for these changes by preparing yourself to handle a few scrapes and cuts along the way.

What is the First Aid Kit?

After years of just dealing with these unexpected expenses, I decided to open up to my partner about my budgeting issues. I honestly, didn’t want to because I enjoyed having extra money to spend for my miscellaneous budget. But being caught off guard financially has its limits, and I had enough. Especially once we started budgeting together and I had to justify why my budget was blown every month. At this point, we decided to come up with a First Aid Kit for our budget. Instead of being caught off guard with life’s unexpected cuts and scrapes, we wanted to be ready with our first aid kit full of bandaids and all. We simply designated an extra $100 buffer to help cover any unexpected expenses that may pop up during the month. But we set up some rules so that I wouldn’t miss use our First Aid Kit (F.A.K).

- Rule #1: Only use the F.A.K for unexpected expenses that are necessary, not wants.

- Rule #2: Only replenish what you use and roll over the unused F.A.K towards next month

- Rule #3: You still have to budget and plan your expenses to the best of your knowledge.

Having these rules allowed us to have money for those expenses without:

- Going into credit card debt

- Pulling from our savings or

- Having to cut other expenses in our budget

Only Replenish What You Use

The best part about adding the First Aid Kit to your budget is that you only have to replenish what you use. Meaning you don’t have to increase your budget every month to add a First Aid Kit to your budget. It’s helpful because we all know these unexpected expenses pop up out of nowhere, but they don’t pop up all the time. So, when they don’t come up, you can just roll that money towards next month. That way you know you have the money available when we need it, but you don’t have to continue increasing your budget for it. Plus, it can help you keep your cost of living as low as possible and still be financially prepared for small needs.

But, what’s the math look like if I do need to pull from my F.A.K?

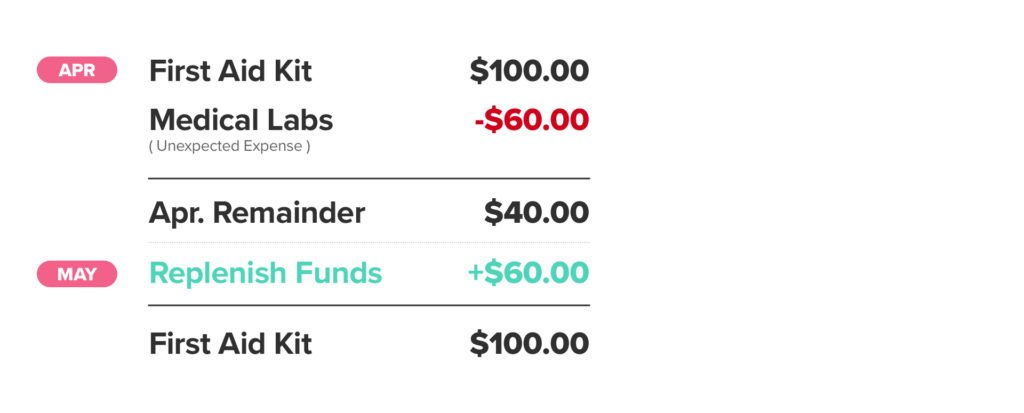

For example, my First Aid Kit of $100 came in handy when my unexpected labs cost me $60. That left only $40 in my First Aid Kit. Meaning that next month I just had to replenish my buffer with $60. This is much easier to handle because it’s a smaller amount and easier to execute vs having to replenish $100.

Protect your Budget from the Unexpected

We’ve used our First Aid Kit for a mix of medical and non-medical uses. I remember using it when we miss quoted our utility bill during those seasonal transitions. We expected our utility bill to be high, but it came out way higher than what we projected. The bill still had to paid and it was nice that we could pull from our First Aid Kit when money was tight. Moving forward we started better projecting how much we would need for those transitional seasons so we wouldn’t need to pull from our F.A.K.

I also remember using our F.A.K for unexpected giving. One time my grandmother needed a medical device that her insurance didn’t cover. It felt so good to be able to quickly send her our First Aid Kit. I also think it’s important to save this money in a place that’s easy to access. Just in case you need to use it quickly. This moment made it clear, that having this money in our bills checking account was the best fit for us. If your using cash envelopes, then a First Aid Kit envelope would be a good option for you.

Your Budget BandAid

Sending my First Aid Kit to my grandmother was a personal choice we took to help her. This buffer can be used at your discretion. Just keep in mind that it’s mostly for unexpected needs that are time sensitive. This isn’t an invitation to overspend or not budget. I know how easy it is to overspend on miscellaneous or go out to eat and use this buffer. But that’s not the purpose of this First Aid Kit. Think of it as a bandaid for your budget.

Closing Thoughts

I hope this blog post helps you if you’re struggling with budgeting or finding it hard to financially manage any unexpected expenses. Since becoming a mom, those expenses haven’t stopped not one bit. But having this $100 buffer that’s replenishable is a great budgeting hack to help you stay focused on the purpose of your money. Because at the end of the day, life is going to give you a run for your money. Just make sure you give life a run right back and protect yourself with a First Aid Kit for your budget.

Other Related Blogs

- What I Wish I Knew About Debt in My 20’s

- How to Prepare your Finances with a Standard Operating Procedure

- Emergency Fund: What is it and How much do I Need?