If price hikes have you tiptoeing around your budget each month, missing savings goals, or feeling behind, it’s not because you’re bad at budgeting. It’s because your budget doesn’t have a buffer.

When every dollar has a purpose, even the most minor changes like higher gas prices, a $15 jump at the grocery store, or an extra doctor’s co-pay, can throw everything off. That stress can escalate quickly. So, if you’ve ever thought, “Why can’t I seem to stay on budget?” the truth is, it’s not you. It’s the lack of margin within your budget.

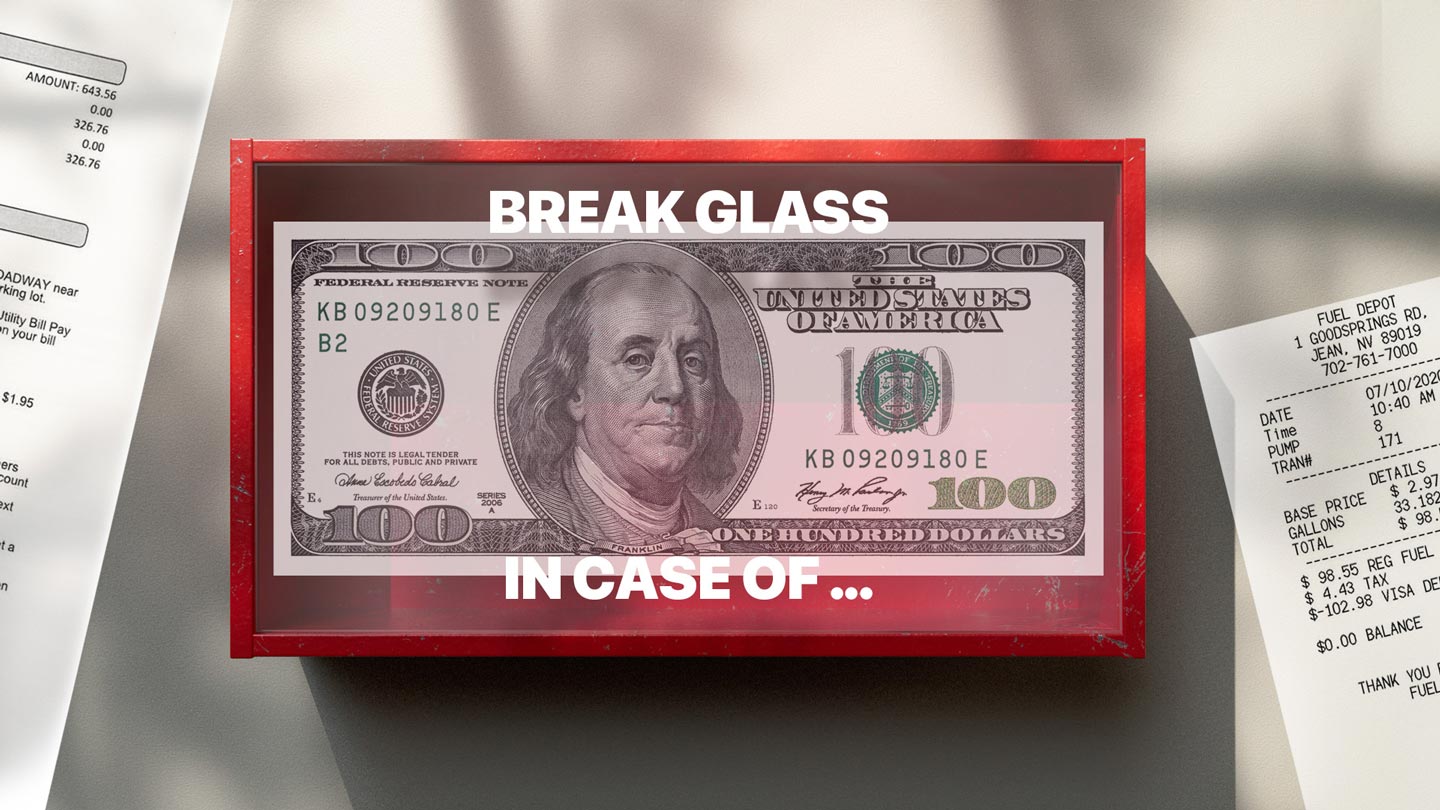

That’s where a First Aid Kit for your budget comes in.

What Is a Budget First Aid Kit?

A First Aid Kit is a $100 buffer that lives in your Bills Checking Account, which is a dedicated account for all your essential monthly expenses within the High 5 Banking Method.

This $100 is not extra spending money, and it’s not a mini emergency fund. It’s a cushion that absorbs the small shocks life throws at you, the expenses that don’t qualify as emergencies but can still derail your budget.

Think of small unexpected expenses like:

- Medical co-pays, medicine, or lab work

- Price hikes on groceries, gas, or utilities

- Small fees, tickets, or unexpected bills

The relief that comes with knowing you have this cushion changes how you feel when those small expenses show up. Instead of panicking, you have a plan, and that sense of preparedness lowers stress and builds confidence in your money system that sticks.

The Rules of the First Aid Kit

As a young girl, whenever I went out, my parents always told me to keep a $20 bill in my wallet just in case I needed it. This parenting moment normalized that unexpected situations can arise out of the blue, and that it’s importance to protect yourself regardless of the fact. I took this lesson and implemented it in my budget by including a strategic buffer to ensure I am always prepared.

To keep this tool as effective as possible, here are a few simple rules you will want to follow:

- Don’t spend it unless you need it.

Treat the First Aid Kit like a buffer, not extra spending money for splurges or lifestyle upgrades. Use it only if you are faced with a genuine need. - Replenish only what you use.

If you dip into it, replace only the amount you spent. This keeps it sustainable without turning it into a recurring bill. - Keep it at a maximum of $100.

If you’re finding yourself constantly using your First Aid Kit, or spending more than $100 each month. This is a red flag to review your budget to make sure it’s realistic. - Keep it in your Bills Checking Account.

Housing the buffer where your essentials live ensures that it does its job, protecting your necessities.

These practical rules keep the First Aid Kit strategic, allowing you to gain flexibility without guilt, confidence without chaos, and control without overspending. It’s a win-win strategy for utilizing a budget buffer.

My Story: The “Siempre Es Algo” Season

When I became a parent, I quickly realized that life was full of curveballs that neither I nor my budget was ready for. Just how I learned that carrying Band-Aids and wipes in my diaper bag was a necessity. I realized that my budget needed a backup plan for my money as well.

One month, it might have been an unexpected doctor visit and the labs that followed. Next, it was cold supplies: cough syrup, tissues, nasal spray, or hand sanitizer.

Although none of these costs were dramatic enough to put me in debt, they were substantial enough to throw off my carefully planned out budget. Month after month, it felt like Siempre es algo, it’s always something.

That’s when I realized these were the gray areas of life. And when I finally implemented my First Aid Kit, I felt prepared. When out with my kids, I knew that if something small came up, such as a co-pay, medicine, or a quick run for supplies, my budget had it covered. That was a massive shift for me. I was no longer anxious about “breaking the budget” anymore. I felt calm, confident, and set up to win financially and as a parent.

Why the First Aid Kit Works

Builds Confidence

A lot of people don’t talk about this, but there’s a real satisfaction in sticking to your budget. The First Aid Kit gives you room to breathe, so when prices rise or surprises show up, you don’t feel like a failure. You have a plan, and that win can help you build your financial confidence month after month.

Secure your Essentials

Regardless of whether you like it or not, bills don’t stop when prices go up. Having a strategic buffer ensures rent, utilities, groceries, and insurance are paid, which means your family’s needs are consistently protected. That peace of mind can reduce stress and help you feel in control, even during unpredictable times.

Avoid Debt

Without a buffer, most people swipe a credit card for those small surprises. The problem? High-interest debt sticks around for a long time if you can’t afford to pay off your credit card in full. A $40 pharmacy run could turn into months of payments with high interest stacked on top. The First Aid Kit helps you avoid incurring small expenses that can lead to long-term financial stress.

Plan for Gray Areas

Some expenses are too small for your emergency fund, yet at the same time, too important to ignore. The First Aid Kit provides structure for these in-between costs, so instead of scrambling, you can respond with confidence. It’s a plan for the things that are bound to happen.

When to Reevaluate Your Buffer

A $100 cushion is a solid starting point. However, if you find yourself draining it every month or spending above $100. That’s a red flag indicating that you need to investigate further what’s going on with your finances. It could be a sign that:

- Your budget isn’t realistic and needs adjusting, or

- You’re in a temporary season of higher costs.

Your First Aid Kit should give you relief, not become another bill you’re constantly funding. That’s why it’s valuable to use it as a tool, not as a crutch.

Bottom Line

Life will always throw surprises: doctor visits, medicine, and rising grocery costs. But your budget doesn’t have to collapse every time it happens.

Adding a $100 First Aid Kit to your Bills Checking Account within the High 5 Banking Method gives your budget the breathing room it needs. You replenish only what you use, you avoid unnecessary debt, and you protect the flow of your money system. This simple tool can provide a sense of control and confidence in your financial management, making it a valuable addition to your budgeting strategy.

Because at the end of the day, budgeting isn’t about perfection. It’s about protection. And when you have a strategic buffer in place, you feel prepared, confident, and in control. Try it this month: add a First Aid Kit to your budget and see how much calmer you feel the next time life reminds you, “It’s always something.”