There’s possibly nothing less downing than talking about life insurance with your friends and family. But from my personal experience, the topic of life insurance is only brought up when we see a tragedy. It’s probably the most unfortunate thing about how we, as people, finanlly take action on these necessities. As a mom, I’ve always seen benefits of getting some type of financial protection in place just incase something does happen to me and my husband. Because of this my husband and I do have term life insurance policies in place for our families benefit. So, in the post, I’ll be sharing the top questions you need to answer before going out to get life insurance.

What’s Life Insurance?

The purpose of Life Insurance isn’t for you, it’s to protect your loved ones financially if you pass away unexpectedly.

So a lot of you might be wondering, what in the world is Life Insurance and do I need it? Oh, and which one do I need and how much do I need as a millennial? Well, many of you might have guessed it, life insurance is just like car insurance, except it’s on your life. That’s right you’re as valuable as any asset so, the best way to protect your life is to insure it. The purpose of Life Insurance isn’t for you, it’s to protect your loved ones financially if you pass away unexpectedly.

Just how living is expensive, not living is no different! Unfortunately, the costs you leave behind can make a hard situation even worse when adding the expensive cost of a funeral. With the high cost of living, old debt, and the responsibility of raising kids can leave any family in a bad financial situation. This is why it important to get life insurance not for yourself, but for your loved ones. So, to answer if you need life insurance, yes. We all do if we’re leaving any financial responsibility on a loved one.

My 6 Life Insurance Points

Once I got into my career, I was offered multiple benefits that were completely new to me with one of those being life insurance. But I got my wake up call about how valuable life insurance was when my cousin unexpectedly passed away. I never realized how many young members of my community were passing away and asking for donations on GoFundMe. This made me extremely sad seeing so many families who could really benefit from having term life insurance. But like most people, they didn’t have it because of the negative stigma about it.

I recommend taking the time to build wealth by investing, owning, and creating new avenues of income during your insurance term.

Life insurance isn’t all the same, they have Whole, Variable, Index, and Term Life Insurance. The only one I recommend to millennials and people in my community is to get Term Life Insurance. The other insurance options are very expensive with low benefits and more designed to leave an inheritance.

On the other hand, by picking only term life insurance you’re able to provide your young family with the income protection your family needs. I recommend taking the time to build wealth by investing, owning, and creating new avenues of income during your insurance term. This way you don’t need to get permanent life insurance, because you will have other avenues to care for your family.

Laddering Term Life Insurance

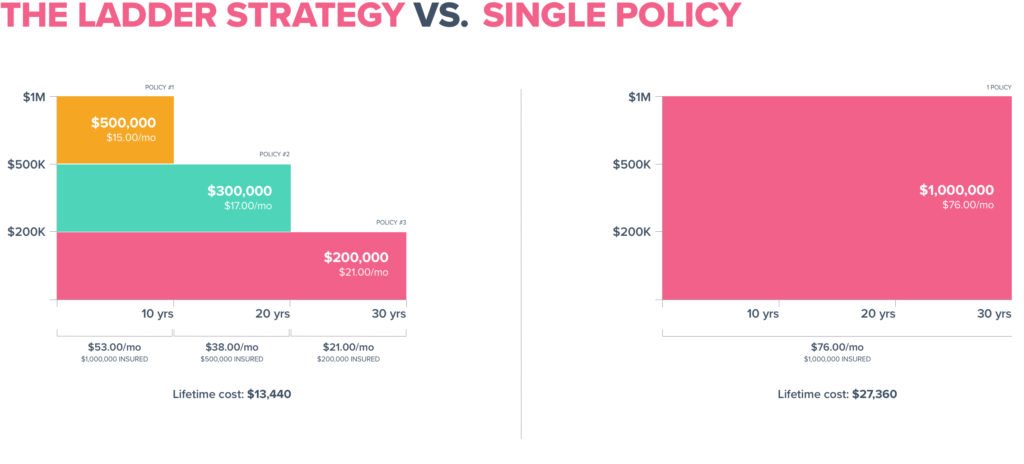

Another thing my family does is called laddering term insurance. This is a great way to lower your costs of life insurance by having multiple term insurance policies that expire at different times during our life. This way we only pay for the higher coverage while our kids are young and have less coverage as we get closer to financial independence. I highly recommend discussing this strategy with an insurance professional before purchasing one large policy or multiple policies.

Now here are the main questions you should answer before getting a life insurance quote as a young millennial:

- What’s your actual situation – Young? Married? Kids?

- Does your job offer term insurance?

- What’s your net worth?

- Do you have dependents or debt?

- How much life insurance do you need?

- Do you need a rider?

1: What’s your actual situation?

When looking into getting life insurance you need to focus on your situation 100%. Don’t focus on what your co-workers or your friends are doing. You need to focus on the protection your family needs and that can be very different than your friends and family. I recommend to ask yourself a few questions:

Are you young or older?

If you’re young, then you probably need some level of term life insurance. Most young people don’t have large amounts of money to cover the costs of an unexpected death. Because of you’re youth and good health, the cost of term life insurance will be very budget-friendly for the level of protection. If you’re older, you need to evaluate your net worth first to see if you have cash for an unexpected passing. Then evaluate your health, the length of the policy, and the coverage needed. Depending on how you answer those questions and your current age, that will determine how much your premiums will be. Now if life insurance still makes sense for you, but the price is too high you can lower your coverage to a price that works for you.

Are you married or single?

If you’re married you need to consider the financial and emotional situation you’re leaving your spouse in. That might be joint debt, like a mortgage or even new debt like your burial service. If you’re single you should consider who your passing away will affect financially, that might be your parents or siblings. You can help them by making sure you’re not put them in a bad financial situation or in debt over your passing. These are very important components to consider when picking the length and coverage of term life insurance needed.

Do you have kids?

This is a big one since, like it or not, it does cost money to raise kids. If you do pass away, what financial situation are you placing your spouse or family member in? Will they be able to handle the cost of raising kids on their own? What kind of lifestyle will your kids now have? That last question got me, because I know I want to give my kids the world no matter what. Consider how much it will cost to raise your kids until they are 18 by evaluating your current minimum cost of living, cost of college, and lifestyle. This number starts to grow pretty dramatically with inflation but first, focus on the support needed for your kids.

2: Does your job offer Term Life Insurance?

I would also recommend getting your own term life insurance if you don’t see yourself staying at your company forever.

When I first started my career I got offered term life insurance 2x my salary. That was more than enough for me since I was young, single, and had no kids. You should definitely take your companies sponsored term life insurance, especially when you’re young. It is usually more than enough to cover an unexpected death and it’s dirt cheap for the company and yourself. This is probably the best first layer of security you can get for any unexpected passing.

Now, If your company doesn’t offer any term life insurance then this is a good time to look for your own. It is very inexpensive and easy to get in the open market if you’re healthy. You can get term life insurance from a financial services company, many popular car insurance companies or a specialized life insurance company. Just do a quick google search. The main thing you need to consider is picking a company with a long and good reputation. I would also recommend getting your own term life insurance if you don’t see yourself staying at your company forever.

3: What’s your Net Worth?

Another thing to consider is how much money you have in your emergency fund or what your net worth is. Your network is literally what you own – what you own, this number will tell you how financially independent you are. For millennials that usually isn’t high due to student loan debt, buying our first homes and starting families. So if your financial safety net isn’t ready yet, then you need term life insurance. But when you get older and you have great savings, a high net worth, and your home is paid off. That’s when you can pick to keep your insurance as an inheritance for your family or not. The point here is to have choices when you get older just in case you don’t need as much coverage.

4: Do you have dependents and debt?

A Will is something to do even if you don’t feel like you have a lot of assets.

The older you get the more people that become dependent on your income, your guardianship, and your support. All of that comes with dollar signs. You have to sit down and really think about who will need financial help if you do pass away unexpectedly. Will it be your spouse, your parents or your siblings who might have to raise your kids. Everyone has a different list and that matters when deciding who will be your beneficiaries’ guardians. This person will also have to manage the money and legal paperwork necessary, so having a Will is a must. Also, consider any joint debts you might have or joint businesses that will struggle without you and your earning potential. A Will is something to do even if you don’t feel like you have a lot of assets.

5: How much life insurance do you need?

The golden rule with life insurance, of any kind, is to have 10x your income. This is to make sure that your family is taken care of financially at least 10 years. The most beautiful thing you can do for your family is to provide and protect them financially, even when your no longer here. If your financially free this is when you can decide if you want to lower your insurance benefit. But this is only an option when your financially free and or close to retirement. Also, the insurance coverage is tax-free, so the amount of coverage you pick is the amount your beneficiaries will get.

6: Do you need a rider?

One of the least popularly discussed benefits of life insurance is the riders. A rider is simply an added benefit you choose to get for a specific perk. The biggest ones are for your children, another adult, or to lengthen your policy. The child and adult rider allow you to pick a death benefit if they pass unexpectedly. The amounts are usually low and will only cover for necessary burial expenses. This is an important add on for many families who have children and/or another adult that needs burial coverage. The last common rider is to lengthen your policy by 5 years, 10 years, or more. Some people want a policy that’s longer than the initial ones offered.

Closing Thoughts

Life Insurance is looked at very negatively in the brown and black community, as blood money. The reality is that it can help with a lot of families deal with the financial hardships unexpected death brings. It can also be a way to guaranty a breakage of the generational financial burden a lot of our families have been carrying. But it’s up to you on how you want to see it. The key is to realize that it’s not for you, but for your kids and family. They’re the ones taking the L if you passway unexpectedly. Hopefully, you get or have some type of term Life Insurance to help your loved ones and find the value of having a financial backup plan.