The way millennials are entering the stock market nowadays is very different than how our parents or the investors before us got in. Now we have all kinds of tech that makes information available at our fingertips, trading is now done on our phones, and spare change is now enough money to get into the market. With all of these advances, investing still seems a bit overwhelming to us. We get scared to jump into the market, since we’ve been brainwashed to believe in the old investing myths or that it’s all a scam. One day the news says the market is up and the next it says it’s down. Yet we still feel a bit behind and in the losing seat, since everyone else is out here investing in their best portfolio.

A lot of us are being introduced to 401(k)’s at work or seeing more headline news about NIKE and APPLE than ever before. That doesn’t make investing any easier, but we are seeing how much investments have gone up and we want in. The best way to actually get into the market is the prepare yourself mentally and financially. The market will continue to do its own thing and no one as has a crystal ball to tell us when it will rebalance. But now is the right time to educate yourself on the investing basics. Here are a few tips on getting on the right track on your journey as a beginner investor:

Get your mindset right

One thing everyone ignores about the stock market is that it’s an emotional poker table. All beginner and intermediate investors get sucked into the news and start making emotional decisions. You have to be realistic with your expectations and understand that the ups and downs is part of the game. The best thing to do is create a game plan when it comes to wins and losses. You do this by figuring out how conservative or aggressive you are as an investor. One of the biggest questions you should ask yourself is “If my portfolio drops by 20% will I sell or buy more?” No answer is right or wrong, your answer just gives you a baseline of how you view your investments.

The Stock Market is not a get rich quick scheme

I really want to note that stock market is not a get rich quick scheme. A lot of new investors are investing in cryptocurrency, penny stocks, and how to trade stock options. I just want everyone to understand that day trading is a full time job and is actually harder than it looks. One thing you don’t see people promoting is that day traders can make a lot of money, lose a lot of money, and owe higher taxes for their short term wins. It’s more than just a 50-50 gamble with some people winning and others losing. It’s actually like one day you make money and the next day you could break even and lose it again. Investing in the stock market is a calculated risk that has hours of homework to back it up. I say this because the best way to learn about the market is to remove all these negative stereotypes that get thrown into the community. Thinking that you will get rich quick will push you to invest more money you don’t have, become greedy, and make big mistakes. My best advice is to come into the investment world ready to learn about the economy and your emotions. Remember that you are beginning and the biggest lessons in the stock market have to be learned with experience.

Learn the investment language

You are going to have to learn the finance lingo one way or another. Start reading blogs on the Acorn app, Robinhood, and Investopedia. All of these blogs will help you learn the language of finance in an easy to understand way. I know when I was learning about stocks and other investments, it was difficult for me to understand the information because of how it was worded. That’s why I like how some of these beginner investment blogs word the information. The reality is that no one is going to do the homework for you to get started. But the more you know, the less likely you will get taken advantage of or mislead. I want to make one point crystal clear, because lots of people think that when they get older they can just pay someone to handle all of their investments. Yes, this is true. But what they don’t tell you is that not everyone has your best interest at heart and many people get tricked into investments that are not well suited for them. This doesn’t happen a lot, but too many women in particular have no clue what they are even invested in. I want something different for my community and sharing the knowledge is key.

Start getting comfortable investing

Focus on getting comfortable with investing by using apps like Acorn, Stash, Betterment, Wealthfront or Wealthsimple. All of these investment apps primarily focus on investing small amounts of money for beginner investors. The Acorn Round-Up feature is probably my favorite feature for those who are having trouble saving money to invest. Think of it as every charge you make on your debit card will be rounded up to the nearest dollar. So, let us say you bought a cup of coffee for $3.50 and then Acorn takes an extra $0.50 to get invested. Now it feels like that cup of coffee cost you $4.00 instead of $3.50 or like you donated $0.50 to yourself. Either way you just got that $0.50 invested and it didn’t hurt that much.

After graduating from college my husband, then boyfriend, told me about Acorn right when it came out. He was testing the app for work and thought of me right away. He knew me well and I really loved it as a beginner investor myself. What we both loved most about the app was that it was easy to use and the amounts that was being pulled was so low, that it didn’t ruin our budget. What I liked specifically about the app was that it taught you about risk tolerance, aka how much risk you are willing to take. And another thing I liked was that the investment funds are well known, they have low management fees, and they have a good mix of ETFs. I also need to note that they do charge a $1-$2 monthly service fee, but they don’t charge you to buy into the investment funds. All of these little details are very important when looking into which app to use.

Understanding what your being invested in

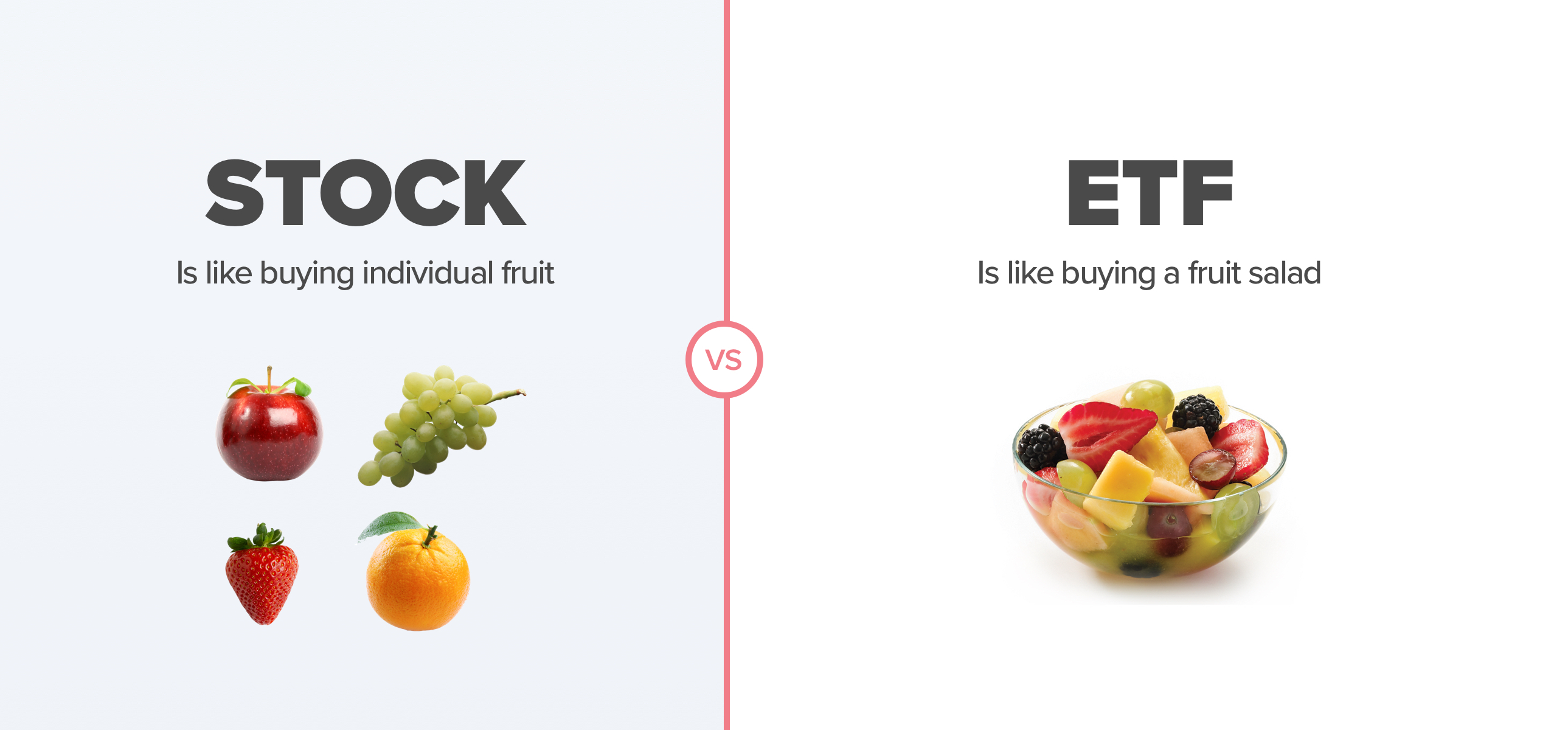

When you invest your money with Acorn or any of the other investing app, like the ones I noted above, it is important to understand what your being invested in. This is the whole point of using these apps, it’s to get your feet wet into the investment world. These apps invest your spare change or very low amounts of money into ETFs, Exchange Traded Funds. Which normally you would have to buy each ETF individually in the market at around $30-$200+ each. These ETFs are a mix of stocks and bonds that follow the market or industry. To put it simply, think of stocks like buying lots of individual fruits to make a fruit salad. You kind of have to buy a lot of different fruit to create a good tasting fruit salad and that can get pretty expensive.

ETFs, on the other hand, are more like buying a ready-to-go individualized fruit salad. You get a taste of many different fruits without having to buy large amounts of fruit or the mess of having to cut up everything yourself. ETFs will give you a small mix of different types of stocks and bonds at a fraction of the price. You also get the benefit of having a stock professional pick the investments in the ETFs, so that they accurately match the market or a specific industry like Tech. We all know that nothing in life is free, so they do charge a smaller fee compared to mutual funds. These are some of the reasons why people are more open to investing in ETFs versus mutual funds, and they historically have higher returns. You would probably make more money owning individual stocks, but that is very expensive and risky for beginner investors. It is best for everyone, including beginners, to have a healthy mix of stocks and ETFs to avoid risk and being overexposed to one specific company. This is why it’s important to see how Acorn mixes your ETFs to give you a balanced portfolio.

What I learned

The best lesson I’ve learned about using investment apps like Acorn is that it teaches you how to set up your portfolio in an easy way to understand. You learn that there are different types of industries and markets that will help balance out your portfolio. This is something beginner investor will not learn if they just jump into the stock market. I found myself a better understanding of how to teach millennials about investing when using investing apps like Acorn. I highly recommend digging into these investment apps to learn more about the stock market and investing. I like that these apps don’t make Investing feels complicated and they can help you learn about investment planning as well.

In Conclusion

To end this long blog post I want to say that I am not trying to promote one investment app over the other or to invest in a specific stock. I want to help you feel comfortable during the uncomfortable stage of investing. Please share this information with those who are seeking to start investing.